Towards a $5 Trillion Economy – Fearless in The Face of Uncertainty

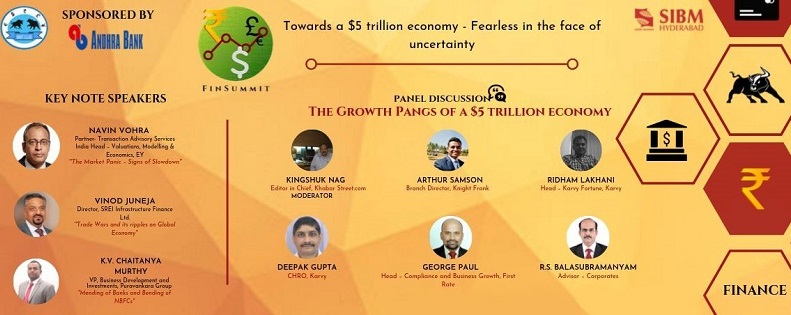

SIBM Hyderabad was proud to conduct the second edition of FinSummit, titled, Towards a $5 trillion economy – fearless in the face of uncertainty on 21st September 2019. This was for the benefit of the students of MBA sculpting their corporate careers.

Three eminent speakers were called for the event; Mr. Vinod Juneja, Director, SREI Infrastructure Finance Ltd., Mr. Navin Vohra, National Head – Valuation and Business Modelling, EY, Mr. K.V. Chaitanya Murthy, Vice President, Business development and investments, Puravankara Group, and a panel discussion Moderated by Mr. Kingshuk Nag, Editor in Chief, Khabar Street.com and discussed by the panellists, Mr. Arthur Samson, Mr. Ridham Lakhani, Mr. Deepak Gupta, Mr. George Paul, and Mr. R.S. Balasubramanyam.

The summit was inaugurated by Dr Ravi Kumar Jain, Director, SIBM Hyderabad with a lamp lighting ceremony. Dr. Shyam Sundar Chitta gave a brief idea about what was going to be discussed in the summit, he spoke about how important it is for the students to understand the current economic scenario and raised the important question, if it is a sign of slowdown of economy or an indication of a recession?

After pondering on this question, Dr. Ravi Kumar Jain spoke about the fundamentals of the latest structural reform and its implications. He stated the three important pillars to survive in the market are – To always know the current market scenario, looking at the macro economic picture and the understanding the functioning of banking sector.

FinSummit’s first speaker, Mr Navin Vohra was invited on stage to speak about “The market panic – signs of slowdown”. He emphasised on the economic slowdown and wanted us to understand how we got here and what we can do to end it. For the last five quarters we have been growing slower as compared to the previous quarters and by taking a look at the parameters it is evident that there is no growth due to lack of industrial growth. In order for us to get the big picture, he took us back to the year 2000 when we faced a similar situation due to the dot com boom. After the year 2011-12, there was a sudden change as we shifted to a value based system. Soon, Commodity prices, input prices declined drastically and various industries started facing a slowdown in their growth rate.

Coming to the reasons for the economic slowdown, Mr. Navin Vohra, highlighted six main points, which are – Lack of investments, demonetisation, GST complexity, high real interest rate, improper currency value, liquidity crunch. He highlighted the different ways in which we can get the economy back on track. They are, availability of monetary space of growth, need to spend on infrastructure, city prices should come down, demographic dividend, need for capital investment, IBC Code, Short term sectoral reforms, Government reforms, Judicial reforms, and Industrial reforms.

Our second speaker, Mr. Vinod Juneja spoke about the trade war between US and China. He differentiated between the physical war and trade war. He gave us several instances such as India conducting various trades with its neighbouring countries. He illustrated how the Trump administration has rolled out stiff tariffs on Chinese imports since 2018, believing it gives white house officials leverage in talks. However, the Chinese government want these to be wiped out before they agree to any broader deal. China has also indicated that it may strike back through limiting rare earth supplies to the US. The speaker concluded by telling us that we all have to be concerned about the impact on others in the supply chain and an escalation of tensions between the US and China in general.

Our last speaker, Mr. K.V. Chaitanaya Murthy, emphasized the mending of banks and the bending of NBFC’s. Before 1950, Banks were a part of an imperial banking system. When Indira Gandhi came to power, she started a welfare driven policy, and most banks were consolidated into nationalised banks. This led to banks leading the lending landscape. The banking regulator has given flexibility to invest a certain portion of funds in the bonds market or overseas or in commercial paper. Indirectly, SBI is funding non-banking money lenders. In 2008, after the US financial crisis where the risk had penetrated into the whole system, the ripple effect led to India not going for privatisation of banks. To stimulate the economy the RBI increased the repo rate to the dismay of banks. When our current prime minister came to power there was a massive drive to create more accounts in order to develop the country, another reason behind this was to have as much control as possible on the banking system. He postulated, that in the coming year or two the country needs to divest its stakes in nationalised banks.

Lastly, there was a panel discussion on the main theme of the summit. The panellists agreed that the words, “$ 5 Trillion” was just a figure. They highlighted that in order for India to develop and increase its growth rate credit discipline needed to be implemented in the system. In the last few years, there has been an increase in the number of entrepreneurs which has led to the implementation credit discipline which is one of the boldest steps that has been taken, this has helped the credit rating system of the country.

We are asked to think of various ways to leverage technologies in rural areas because that is where opportunity and cash flow lies, and it is how India will grow. It is important for us to take the time to plan how to roll this out especially for the unorganised sector. The panel discussion concluded with the hard fact that the slowdown is around us, especially in the automobile sector; it has been prevalent for the last two years and its impact is finally being felt.

The second edition of FinSummit 2.0 came to an end with the vote of thanks given by, Thota Praneeth, Head of Mint Club, SIBM – Hyderabad.

It was indeed a very enlightening event

It was a very informative and interactive session.

Very practical approaches discussed.

Very interactive and informative session.

Practical approaches explained.

Very interactive and informative session.

Practical approaches discussed.