“Beware of little expense; a small leak will sink a great ship.”

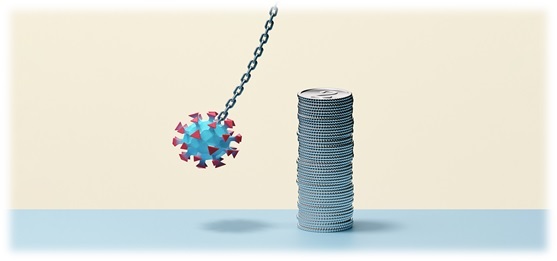

A wonderful quote by Benjamin Franklin completely fits the current scenario. Until January 2020 when news about coronavirus began to circulate, no one would have thought that the spread of virus could have a long-term serious impact on an individual’s financial situation? Although we may not have seen the full impact of COVID-19, people are already under pressure due to salary cuts and unemployment. Although discretionary expenses might decrease due to lock-down, managing household expenditures with limited resources is a great concern now. However, it is also necessary to pay close attention to financial goals and try to ensure that they proceed as planned. The current situations have created such circumstances that every household not only in India but all over the world is concerned about the daily expense for survival. While people with strong financials are using their savings or incomes, there are people who are left either to die in hunger or travel in search of earnings.

Uncertainties as of now are fear, anxiety and stress, but brings in rare investment opportunities. If you can control your emotions and consider the situation objectively, then you can identify these opportunities, and also take quick action for your advantage. Whenever the market is sluggish, the first thing you need to do is to check your investment tools and thoroughly understand what stocks you own and how to invest in them. The reason is obvious, and a quick glance at the global index clearly shows the economic impact of this disease on countries. When we do this, we can see that although the market has come down, the bullish trend has also recovered within a few weeks. Investment decisions should be guided by asset allocation, which is based on your investment objectives, investment scope, and risk tolerance. During such difficult and uncertain times, most investors will naturally prefer capital preservation, tending to retain cash reserves and postpone investment decisions. However, turbulent times do provide opportunities that you need to take advantage of.

What are those 5 most essential money matters that one needs to attend to in these times?

- Your wealth advisor evaluates the portfolio to ensure it is fully aligned with your risk and return goals

- Make sure that your investment portfolio includes basically sound stocks, mutual funds, bonds, deposits, etc. If you need to replace bad stocks with outstanding stocks, please readjust.

- Maintain an emergency fund equivalent to six months of daily expenses to deal with possible pay cuts or unemployment.

- Use comprehensive health insurance to ensure that you and your family have adequate coverage for unexpected medical expenses.

- Invest in life insurance and consult your financial advisor about appropriate coverage. The thumb rule is that the guarantee amount should be equivalent to 15 times the annual income.

Well, the current pandemic reiterates that the demand for insurance is more important than anything. Therefore, if you have not chosen a life insurance or health insurance plan, now is the best time. We may all feel that we have time, but if this pandemic proves everything, then it is a lesson, and safety is better than regret. In addition to this, you can enjoy lower premiums when you are young, which is an additional advantage.

The governments all over the world are trying to stabilise the economy but it will take time. The loss due to this pandemic is such that the financial recovery will take time and it won’t be same. The packages or relief funds offered are just a little help to survive the pandemic. People should think about what triggers the extra spending and rather help the needy ones in any possible way they can.

It is difficult to say exactly what will happen in the coming months, but it is sure that this will become our new normal and last longer than everything. Even if you are not experiencing difficulties now, still you must adjust your financial situations. The most important thing to remember is that in the next few months, the current situation may and will reverse. Look at the recovery of the Chinese market; this in itself proves how our own stock market can recover and grow. At the same time, the most sensible financial objective you can have is of course to assess your risk and, if possible, continue to invest, save and spend wisely. Try to help those who are in need. Stay home, stay safe and stay healthy.

Author is an MBA Finance Specialisation Student of Symbiosis Institute of Business Management, Hyderabad