“In year 2012, to increase penetration of mutual fund products and to energize the distribution network, SEBI allowed to levy additional expenses up to 30 basis point on the inflows from beyond top 15 cities. After more than five years’ regulator has now decided that the additional TER of up to 30 basis points would be allowed for inflows from beyond top 30 cities instead of beyond top 15 cities. The flows from Next 15 cities are study and the range of 5 to 6 percentage of Total assets under management. Again in same year i.e 2012, SEBI mandatorily introduced of Direct & distributor sold plans for each MF scheme.

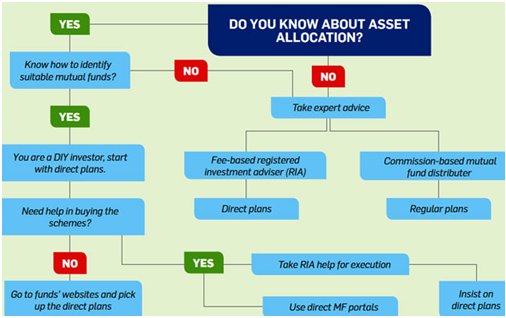

Since them, popular media often write about direct plan’s superiority in terms higher returns and lower expense over broker sold or regular plans. Kumar Dhirendra (2017) argues about why direct plans are not suitable to naïve investors. Typically, the flowchart shown through figure below depicts investor’s choice to opt for regular plan or direct plan.

Source: Nathan Narendra (2017)

Retail Investors typically do not have abilities about asset allocation, fund selection. This inability coupled up with reluctance towards paying advisory fees push retail investors to opt for regular plans.

Nathan Narendra (2017) shows the average three-year performance differential between direct and regular plan ranges from 0.5 to 4.08 percentage depending on the fund category.

Let us take a hypothetical situation if all retail investors in October 2014, would have remained invested in MF regular products then, they would have lost more than 6000 crore (refer Table below).

| Type of the product | Retail assets under Regular Plan (as on October 2014) | Average Higher returns* | Monetary loss as on October 2017 |

| Liquid/ Money Market | 2500.98 | 0.5 | 12.5049 |

| Gilt | 310 | 2.46 | 7.626 |

| ELSS | 26536.19 | 3.91 | 1037.565 |

| Others | 114926.67 | 4.12 | 4734.979 |

| Balanced schemes | 8011.34 | 3.7 | 296.4196 |

| Total | 152285.18 | 3.99 | 6089.094 |

| * The difference in the average returns of the direct and regular plans of each category has been used for calculations. Only schemes with AUM of at least Rs 100 crore were considered. Source: Value Research. Figures are as on October 2017. | |||

The corresponding figures for corporate investors and HNIs are INR 1833 crore and INR 3787 crores. The retail investors are biggest looser.

I will not deny importance of regular plans in underdeveloped (in terms of awareness, infrastructure) markets.

It is right time to stop selling regular plans in Top 15 or at least in top 5 cities. The ecosystem needed for direct plans is ready due to eKYC, mutual fund portals, trading platforms like MF Utility, platforms from exchanges, etc. The step will be pro investor in long run. Typically, an investor loose by investing in regular plans. Though there are some intermediaries offering direct plans through fee based model but the moot point is retail investor’s unwilling to pay fees. But a campaign like “Mutual Fund sahihai” can create a traction in the category then just extrapolate about another campaign on the lines of “paying advisory fees is right”

Though this step will be considered very bold. But “banning entry load” in Mutual fund industry was also very bold step taken in the past by SEBI.

Certainly MF companies will resist. Rather MF companies are busy in creating novel ideas to incentivize channel members (Do read a news in Business Line titled “Breach of trust” or follow the link https://www.thehindubusinessline.com/opinion/editorial/breach-of-trust/article24565478.ece).

The key is regulator’s volition.

References:

- Nathan Narendra (2017), How direct plan mutual funds can help you create greater wealth in the long termRetrieved on July 29, 2018 from https://economictimes.indiatimes.com/wealth/invest/how-direct-plan-mutual-funds-can-help-you-create-greater-wealth-in-the-long-term/articleshow/61698840.cms

- Kumar Dhirendra (2017) Why direct plans of mutual funds may not suit all types of investors posted on Jun 12, 2017, 06.30 AM IST Retrieved on July 29, 2018 from https://economictimes.indiatimes.com/articleshow/59081237.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst